The DVORAK Group became anchor investor with a 35% stake in the German machining company Carl Leipold GmbH. Carl Leipold GmbH is a traditional German company based in the Black Forest, Germany, which is specialized in high-precision manufacturing of complex turned parts. After the company filed insolvency proceedings under self-administration, business operations have been continued own leadership since November 1st, 2022 with the aim of sustainable restructuring.

An acquisition concept was developed with the help of the Viennese law firm BRANDL TALOS under the leadership of the partner Stephan Strass. This was already presented to the creditors in the course of legal proceedings and approved unanimously. The result of this was the exit of the insolvency proceedings with legal effect beginning of June 2023.

The insolvency plan also includes the closure of the LEIPOLD plant in Dransfeld and the sale of the US subsidiary in Windsor, Connecticut. As an anchor investor, the DVORAK Group makes a decisive contribution to the strategic realignment and capitalization of the company by providing equity and debt capital.

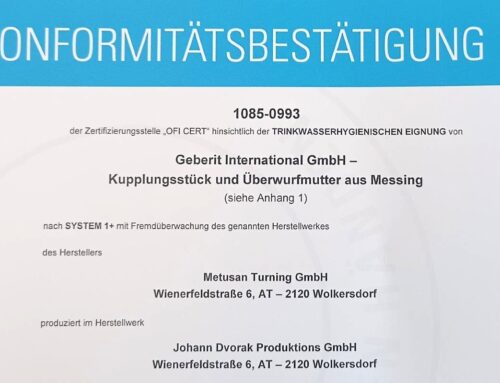

“We will further develop the strengths of the two houses in a partnership” – explains Dr. Michael Fischer, Managing Director of Johann Dvorak Production GmbH. This will be done under the “THE TURNING PARTNER” brand. “THE TURNING PARTNER” opens up an extensive product portfolio of turned/milled parts with a wide range of materials, dimensions, technology and design optimization (smarter design) to the customer.

The Carl Leipold GmbH, which previously appeared on the market with its branding “LEIPOLD – The Precision Group”, will do so in the future as “LEIPOLD TURNING” based on the new partner “METUSAN TURNING”.